Why Executive Condominiums will remain attractive to young buyers

Written by: Timothy Eng, Research Team

Estimated Read Time: 6 minutes

Prices of new executive condominiums, a popular hybrid segment combining private housing features with public housing eligibility criteria, reached record levels in recent years. New launch prices rose in tandem with growing demand, short supply, and increases in prices of land for Executive Condominium (EC) development.

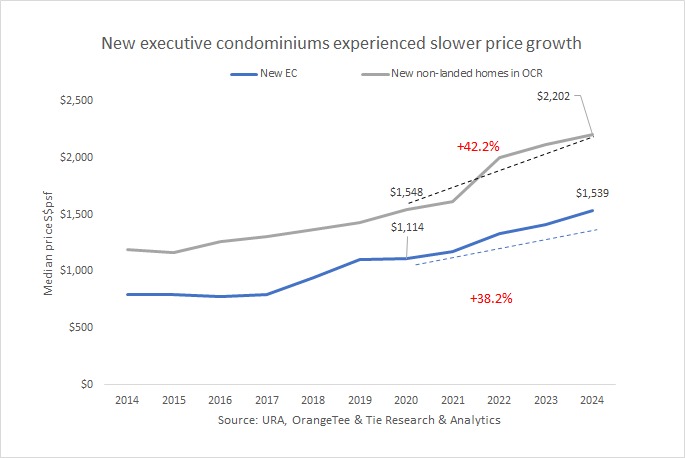

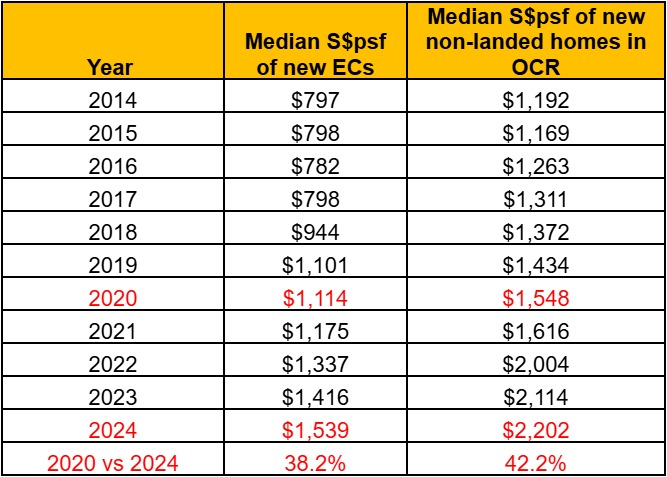

Chart 1 New ECs experienced slower price growth compared to new non-landed OCR homes

Based on data from the Urban Redevelopment Authority (URA), the median price of new ECs hit a new high of S$1,539 per square foot (psf) in 2024. However, prices have risen at a slower pace compared to other private properties in the suburbs or Outside Central Region (OCR) over the past five years (Chart 1), and ECs continue to look comparatively reasonable relative to other new private homes in the market.

The median price of new ECs rose by 38.2% from S$1,114 psf in 2020 to S$1,539 psf in 2024. In contrast, prices of new non-landed properties surged by 42.2% from S$1,548 psf to S$2,202 psf over the same period.

ECs are sold at lower prices than private condominiums despite being built by private developers. The government greatly subsidises new ECs with grants that are comparable to those given out for public housing flats. An EC project is privatised 10 years after its completion; thereafter units in the development can be sold to foreigners.

However, ECs are subjected to more restrictive buying conditions, eligibility requirements, Minimum Occupancy Periods (MOP), and specific resale criteria which are similar to Build-To-Order (BTO) flats. To be eligible to buy a new ECs, buyers must be Singapore citizens or a citizen married to a Permanent Resident. In addition, buyers are not allowed to hold other properties during the MOP and must adhere to a Mortgage Servicing Ratio (MSR) in addition to the Total Debt Servicing Ratio (TDSR).

Source: URA, OrangeTee & Tie Research & Analytics

One possible reason why new EC price growth lags other segments could be the borrowing limits and income ceiling rules imposed on EC buyers, put in place to ensure the properties stay accessible and buyers do not end up overstretching their budgets.

Eligible EC buyers are required to comply with a 30% MSR on top of the existing TDSR rules, meaning borrowers can only use 30% of their gross monthly income to repay their mortgage for a new EC. Moreover, buyers of new ECs are subjected to a household income ceiling.

If EC prices rise too steeply, buyers face high cash outlay, which may price out many.

Consider a couple with a combined income of S$16,000 buying a new EC. They can only borrow up to 75% of the property price, which works out to around S$1 million based on the MSR and income ceiling. If the buyers opt to purchase a 1,000 sq ft 3-bedroom new EC for S$1.5 million at S$1,500 psf, S$500,000 of the property price must be paid in cash or CPF (of which 5% of the selling price must be paid in cash), in addition to stamp duties, lawyer’s fees and other miscellaneous costs.

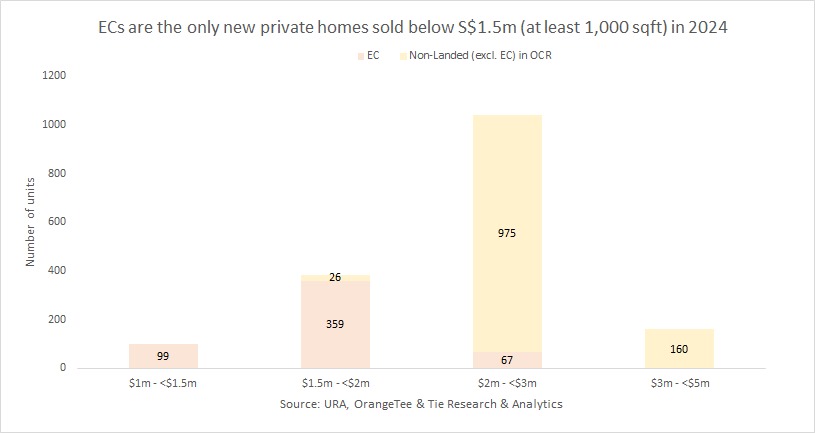

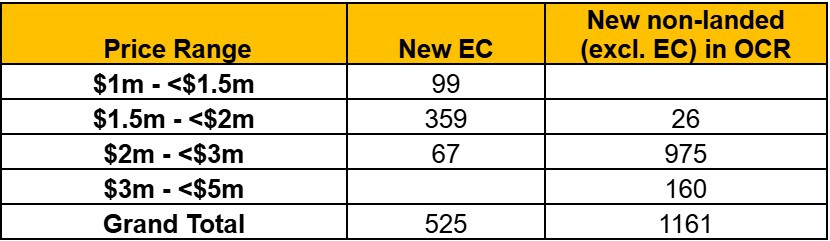

ECs are the only new private homes sold below S$1.5 million

Homebuyers seeking a condo of at least 1,000 sq ft priced under S$2 million have limited options in the private residential market. In 2024, it’s even more challenging to find a new unit of that size for below S$1.5 million.

Chart 2 ECs are the only new private homes sold below S$1.5 million for units of at least 1,000 sqft in 2024

Source: URA, OrangeTee & Tie Research & Analytics

Such units made up 18.9% (99 units) of all new EC transactions (525 units) last year (Chart 2). Further, 68.4 per cent (359 units) of the new ECs of at least 1,000 sqft were sold for between S1.5 million to under S$2 million.

In comparison, only 2.2% of new private condo units in the OCR of at least 1,000 sq ft - or 26 units - were sold at between S$1.5 million and less than S$2 million in 2024. The majority of new condos in OCR (84% or 975 units) were sold for at least S$2 million but less than S$3 million.

Almost all new ECs are profitable

EC deals are also showing strong potential to be profitable. Our profit analysis shows the majority of ECs were profitable on resale.

Gains and losses of individual EC units were calculated by matching URA Realis new sale caveats between 2007 and 2024 to the resale caveat of the same unit over the same time frame. The calculation does not consider costs such as legal fees and interest.

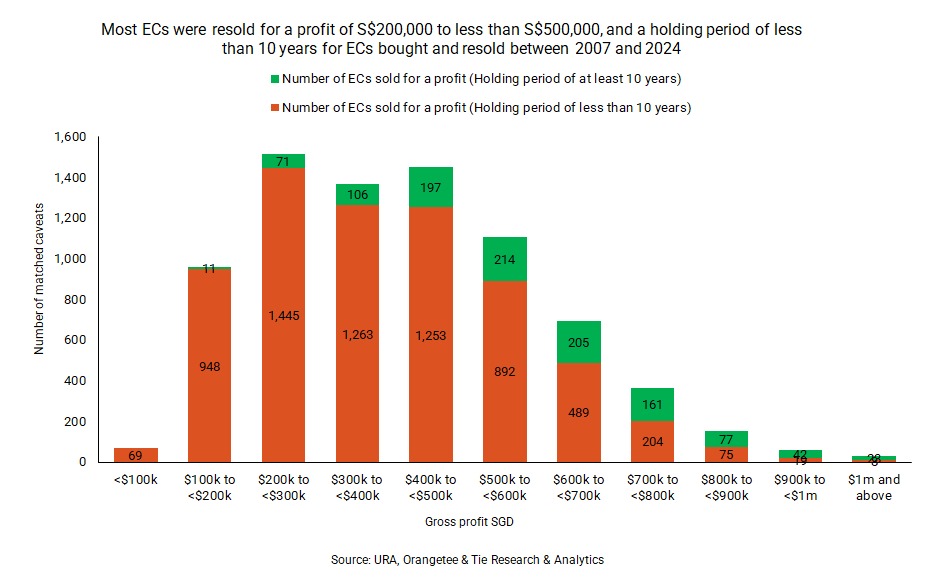

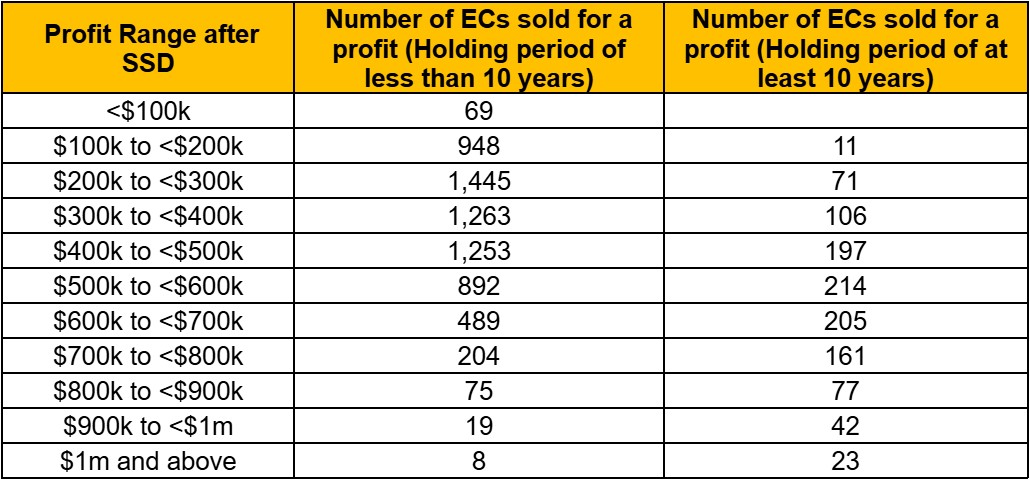

Chart 3 Most ECs were resold for a profit of S$200,000 to less than S$500,000 and with a holding period of less than 10 years (for ECs bought and resold between 2007 and 2024)

Source: URA, OrangeTee & Tie Research & Analytics

There were 7,775 matched caveats mined from a database of 29,971 new EC transactions. 99.96% (7,772 units out of 7,775) of the sample ECs were profitable, yielding an average gross profit of over S$413,000 each after considering Seller’s Stamp Duty (SSD). Of this number, 2,409 units generated a gross profit of at least half a million each, with 31 units exceeding S$1 million (Chart 3).

The highest profit recorded was for a unit at CityLife@Tampines bought in 2013 for S$1.91 million and resold for S$3.29 million in 2021, yielding a record profit of S$1,376,100. The next highest profit was from a unit at Esparina Residences which was resold for a profit of S$1,335,000 in 2023. The third most profitable unit was an EC at Prive resold in 2024 for a gross profit of S$1,282,300.

The large gains came out of the recent run-up in EC prices, yielding high profits over a lower cost price compared to private condos. Moreover, eligible buyers can receive a housing subsidy of up to S$30,000 under the CPF Housing Grant Scheme.

While the launch prices of Executive Condominiums (ECs) may rise, resulting in smaller profit margins, we anticipate that the demand for ECs will remain healthy in the long run due to their limited supply and comparatively lower price points compared to other private properties.

Limited supply sustains EC prices

The market for ECs may continue to see measured growth. Demand for new ECs (18,721 units sold) has been outpacing the number of units launched (15,404 units) over the past ten years (2015-2024).

Up to three EC projects may launch this year: the 760-unit Aurelle of Tampines, the 710-unit site at Jalan Loyang Besar and a 560-unit development at Plantation Close. Therefore, this year’s EC supply, at 2,030 units, may be higher than the 1,540 EC units averagely launched per year between 2015 and 2024.

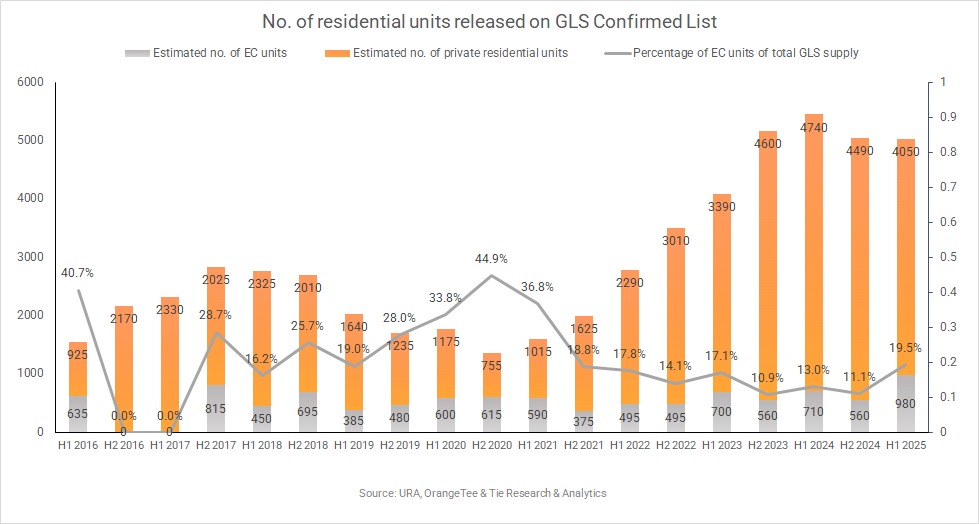

Chart 4

However, the supply of EC units under the Government Land Sales (GLS) programme remains relatively small compared to the total units released. Since H2 2021, the proportion of EC units released into the market in each half-yearly GLS programme has been less than 20% of the residential units introduced (Chart 4). While three EC sites may be released for tender in H1 2025 GLS which will lead to an estimated total of 980 units, it will still only form approximately 19.5% of the total residential supply. With EC land supply remaining relatively scarce, prices and demand may likely be sustained this year.

Blog

Do "Lucky" Floors Actually Make a Difference in Property Profits?

Media Collaborations

Revival in demand for private resale homes

Media Collaborations

Can your home fetch more if it is on an auspicious floor?